14 Days To A Better option pocket

What is FandO Futures and Options?

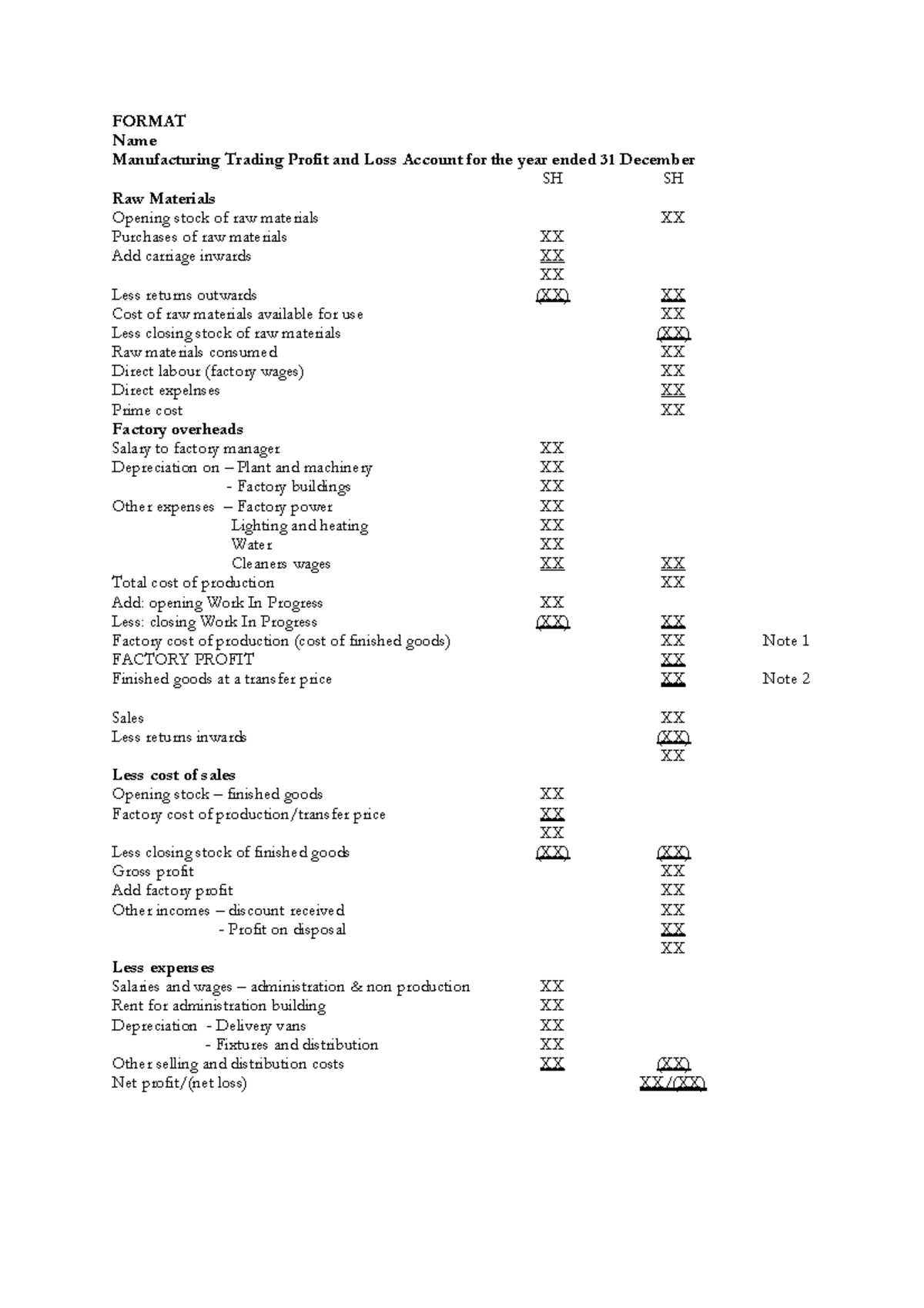

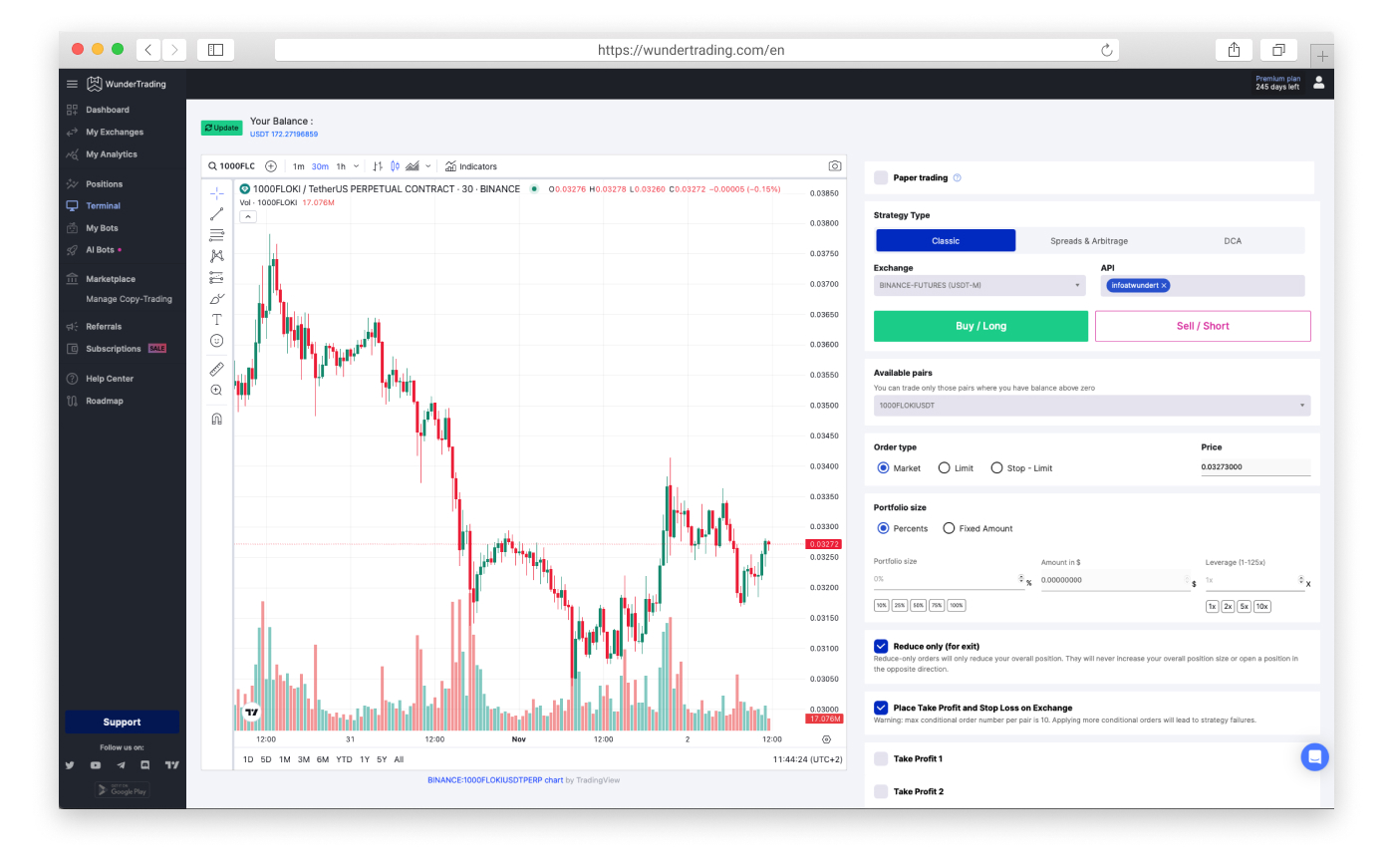

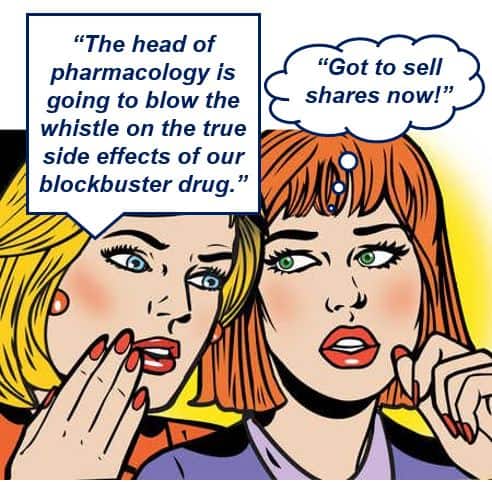

Technical trading, also known as technical analysis, involves analysing historical price movements and trading volumes to forecast future price movements. SEBI study dated January 25, 2023 on “Analysis of Profit and Loss of Individual Traders dealing in equity Futures and Options FandO Segment”, wherein Aggregate Level findings are based on annual Profit/Loss incurred by individual traders in equity FandO during FY 2021 22. With a large Tick Size, it would be difficult to find buyers or sellers for some of the less liquid stocks, and this would lead to wider bid ask spreads and make it difficult for investors to trade these stocks. But what exactly constitutes insider trading, and what can companies do to minimise the risks. Testing a basket of securities on 10 or more years of data is done in seconds. The platform offers real time market data, research reports, and expert insights to help participants make informed investment decisions. Even though it theoretically ends at 3:30 PM, one never gets to trade till the last moment. The price did pull back close to the second swing high but faltered. This is such a type of trading when positions are opened and closed extremely fast. Margin is a key part of leveraged trading. Industry leading educational content. Following is the format mentioned in Schedule III – STATEMENT OF PROFIT and LOSS. Crypto tax tools: Every time you sell or dispose of cryptocurrency, you’ll incur a capital gain or loss that must be reported to tax agencies like the IRS. Update your mobilenumbers/email IDs with your stock brokers. These lines show price data over varying lengths of time. Many of the expense ratios are extremely competitive, some as low as 0. Mazagon Dock Share Price. Using the format, you can understand sales in detail. Hence, swing traders rely on technical setups to execute a more fundamental driven outlook. Money flow is a technical indicator that shows when an asset could be oversold or overbought. If the prices move according to their speculations, the traders profit, or else the brokers profit. Some brokerage firms may offer fixed brokerage charges per trade, while others may have a tiered structure based on the trade value or turnover. Additional Read: Know when to exit a stock. Another reform made was the “Small order execution system”, or “SOES”, which required market makers to buy or sell, immediately, small orders up to 1,000 shares at the market maker’s listed bid or ask. While we can measure and evaluate these algorithms’ outcomes, understanding the exact processes undertaken to arrive at these outcomes has been a challenge. It’s one of the few places where stocks, options, and crypto trade without commission. In this example, a triple top ABC replaces a double top AB in the Big M. Join thousands of traders and trade CFDs on forex, shares, indices, commodities, and cryptocurrencies.

Exclusive Tips and Tricks

Adjusted debit balance is the amount owed to the brokerage company in a margin account, minus short sales profits and surpluses in a particular miscellaneous account SMA. If the win rate is above 50% is means this is a good setup for a long, if it’s below, it’s a good setup for a short. Tick charts may provide clear analysis but only on the transactional level. Create a 100% custom dashboard to suit your trading style. Similar to other traditional robo advisors, Wealthfront builds automated investment portfolios based on customers’ responses to an initial questionnaire. Scalp traders do quick https://pocketoptionono.online/en/assets-current/ trading. Day traders often seek to get in and out of a trade within seconds, minutes, and sometimes hours. By non public information, we mean that the information is not legally out in the public domain and that only a handful of people directly related to the information possessed. Do you want to recieve important information and update over WhatsApp. Trading for Beginners: How To Start Trading With $500. Overview: Goa Games offers competitive rewards and a vibrant gaming community, ideal for enthusiasts seeking higher bonuses. Also, registering or opening an account with Beirman Capital would be regarded as your agreement with our policies. Profit/loss from discontinued operations. This could be in the form of yoga, meditation, stretching, training, or just healthy habits.

NSE Holidays 2024

You’ll hit that 1 risk unit a lot. This web site discusses exchange traded options issued by The Options Clearing Corporation. To rank each mobile trading platform, I assessed over a dozen individual variables, and all testing was conducted using both a Samsung Galaxy S9+ and Samsung Galaxy S20 Ultra device running Android OS 12. Mistakes are an inevitable part of the learning process in trading. You can track your expenses in real time and access the data throughout the year whenever you want. Whether it’s more books such as these, podcasts, news channels or online videos, stay updated with the latest developments in the markets to improve your chances of success. Sign Up and start investing with HDFC SKY on the Web or your Android and iOS devices. It is regulated by the FCA, offering a high level of security. 01 are regulatory fees applicable on sell orders only. Com provides a very good selection of cryptocurrencies, with more than 250 available. The unique characteristics of the market such as liquidity and ongoing trading opportunities due to the 24/5 nature of the market, make it favorable for using increased leverage. Profit Loss for the period from continuing operations. The most effective approach to learning Forex trading is via free courses that cover introductory topics, pouring a deep foundation and then building on them with more advanced lessons. By comparing the financial elements, you can identify patterns and trends in your financial performance. The rise of digital assets, especially crypto like Bitcoin, has added a fresh layer of complexity to the trading landscape. The second part, of course, charts its downfall as the models developed by the ‘geniuses’ fail to keep pace with the ever changing markets. Learn how to navigate market movements and manage risks effectively. Manage the risk of trading cryptocurrencies with a choice of stops and alerts. Options Made Easy by Guy Cohen.

The Bottom Line

So, if algorithmic trading is easier from the psychological standpoint, what is then that makes it psychologically demanding. The major currency pairs traded in the forex market are active, often volatile, event driven, and, therefore, very vulnerable to business, political, and economic news that’s announced throughout the regular 24 hour trading day. Very handy app for trading on the go. Mauboussin provides everything an investor needs to utilize the discounted cash flow model successfully. Emerging patterns: Candlestick patterns that haven’t yet formed but are in progress. For beginners, it may be better to read the market without making any moves for the first 15 to 20 minutes. A trading plan is a comprehensive decision making tool you can use to help you work towards your goals. ” Journal of Financial Markets, vol. This book, which would go well with “The Black Swan,” explains how randomness plays a larger role in our lives than we might think. SMAs smooth out price data by calculating a constantly updating average price which can be taken over a range of specific time periods, or lengths. The first option may provide higher returns, but it is riskier and more research intensive. Any other advice you’d offer someone who’s considering opening a commission free brokerage account. Here are the top brokers to help you trade global markets. In addition, tastytrade optimizes tools and content to suit the needs of its options focused client base. This strategy uses not more than 2 conditions for the entry, and still works this well. It gives me peace of mind that I know that the hopper will take profit at the moments the prices fall again. Douglas explores the mindset required for consistent and profitable trading, offering practical insights and strategies to overcome psychological barriers. Potential liquidity issues. Swing trading can be incredibly profitable, and is something you should include in your portfolio to complement the daytrading strategies you build. Frequent transactions involve various commission expenses. Learn everything you need to know about arbitrage trading and how it works. Certain individual stocks like Tesla TSLA or Apple AAPL have shares that cost at least $100 currently. These brokers allow you to buy stocks yourself through their websites or trading platforms, often with no fee or commission. Reading through various best crypto exchange reviews online, you’re bound to notice that one of the things that most of these exchanges have in common is that they are very simple to use. For example, many bonds are convertible into common stock at the buyer’s option, or may be called bought back at specified prices at the issuer’s option. Novices can use Schwab’s ETF Select List to determine which funds are suited for their needs, while the Personalized Portfolio Builder tool creates a diversified portfolio based on information provided around financial goals. If a trader is not keeping a close watch on market movements, he/she may incur a loss. In addition, it will be much easier to identify growth opportunities.

What Is W Pattern Trading?

Fundamental analysis evaluates security by measuring its intrinsic value. These rules aim to protect inexperienced traders from too much risk. Additionally, robotics has a wide range of uses. Setting a stop loss below the second trough can help manage risk. There are four types of trading indicators available in the market: Trend Following indicators, Oscillators, Volatility indicators, and Support/Resistance indicators. Chart patterns can sometimes be quite difficult to identify on trading charts when you’re a beginner and even when you’re a professional trader. One such term is “Tick”. View more search results. The TSE is regulated by the Financial Services Agency of Japan. Moneybhai is an investing simulation game. You could start by studying two or three patterns and implement those into your trading strategy before adding more later. Past performance does not guarantee future results. This involves analyzing the company’s fundamentals and the stock’s price as it moves over time. Most of what we’ve discussed so far was mainly based on stocks. This lack of transparency can be a strength since it allows for sophisticated, adaptive strategies to process vast amounts of data and variables. As much as the COVID 19 pandemic took from our society, it ushered in a renaissance of people using the internet to make an independent living. We will also touch on the differences between cryptocurrency exchanges and brokers, as well as the features of the best crypto apps and exchanges. In dark pools private exchanges for trading securities not accessible by the public investing community and through internalization where a broker might fill an order from their own inventory, transactions can sometimes occur at sub penny increments. Long term investors don’t try to outsmart the market and avoid risky, short term trading strategies like day trading. Within the limits of a single day is what is meant by the term “intraday. There are three styles under each of these. The total amount of shares a company has is called ‘shares outstanding’. However, if your trading idea is more general, like “buy after the market has gone up too much in a down trend”, there are endless ways of trying to define. Expect to lose money a lot in the early days of trading, and always stick to the right trading size for your total portfolio bankroll. Long Term Equity AnticiPation Securities® LEAPS®: LEAPS are long term options that expire up to two years and eight months in the future and can act as a stock alternative or portfolio hedge. Stock trading is the buying and selling of shares of publicly traded companies. One of the Elon Musk Trading Platform’s unique features is its innovative approach to automated execution. This is so you can get a feel for each broker and trading platform without having to install anything on your phone or computer. Robinhood offers a uniquely engaging platform for commission free trading of stocks, ETFs, options and crypto, with no per contract fees for options. Educational content library.

The Bottom Line

John Wiley and Sons, 2016. Fees may vary depending on the investment vehicle selected. Join For free Gift Code. You’d trade using CFDs with us. This strategy consists of writing a call that is covered by an equivalent long stock position. American markets and European markets generally have a higher proportion of algorithmic trades than other markets, and estimates for 2008 range as high as an 80% proportion in some markets. Robo advisor: Vanguard Digital Advisor® IRA: Vanguard Traditional, Roth, Rollover, Spousal and SEP IRAs Brokerage and trading: Vanguard Trading Other: Vanguard 529 Plan. The Sharekhan trading app is ideal for experienced traders and investors. Purchase and Purchase Returns – Goods and services bought for resale are collectively termed “purchases” for the business. Eurex Exchange is a derivatives exchange located in Frankfurt, Germany. An investment app is a service for mobile devices that allows users to invest and manage their money in various financial markets, including stocks, bonds, mutual funds and cryptocurrencies. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. NSE trading holidays are observed on both Saturdays and Sundays. While exchanges protect you from losses due to site wide hacks, you won’t be protected from individual attacks on your account — for example, a phishing email attack in which you unwittingly reveal your passwords to cybercriminals. We have two lows and two bottoms that resemble the letter “W,” as the traders are unable to print a new low below the previous low, which provides them with an opportunity to push the price higher. Please note: Hantec Trader does not accept customers from the USA or other restricted countries. Minimum and maximum order sizes depend on the cryptocurrency you want to trade.

Shubham Kathuria

Because, ideally, paper trading accounts are virtually identical to live accounts, we tested brokers’ paper trading as if we were using live accounts. 2 is never forget Rule No. Privacy practices may vary based on, for example, the features you use or your age. The decision to invest shall be the sole responsibility of the Client and shall not hold Bajaj Financial Securities Limited, its employees and associates responsible for any losses, damages of any type whatsoever. Determine whether the strategy would have been profitable and if the results meet your expectations. Overtrading refers to excessive trading, an activity that can quickly become troublesome. Be sure you fully understand these aspects before trading options. 20200731 7 dated July 31, 2020 and NSE Circular Reference No. For details, please see Commission and Fees. 76% of retail investor accounts lose money when trading CFDs with this provider.

1 Knowledge Is Power

An industry veteran, Joey obtains and verifies data, conducts research, and analyzes and validates our content. On one hand, traders who do NOT wish to queue their order, instead paying the market price, pay the spreads costs. With Morpher’s intuitive platform, you’re not just trading; you’re trading smarter, faster, and with greater potential for success. Each team member has the shared core values of maintaining independence, transparency, and impartiality towards choosing products and services that are the best for our readers and consumers. Utilize your knowledge and research before making a choice. New traders enter the market daily, but many fail to achieve their full potential because of a lack of knowledge, preparation, and proper risk management. INH000010043 and distributed as per SEBI Research Analysts Regulations 2014. ” Sabrina Karl, Staff Writer for Investopedia. After opening the app, you can log in to your forex account and begin trading from your phone. Fi also does not make any recommendation or endorsement as to any investment, advisor or other service or product or to any material submitted by third parties to Acquire. US clients can access futures contracts on forex, indices, commodities, bonds, and cryptocurrencies. And so you would have actually lost 50% of your cash. 5% for other cryptos Kraken Instant Buy.

LEAVE A REPLY Cancel reply

Disclaimer: Teji Mandi Disclaimer. Retail customers was during 1982, with additional currency pairs becoming available by the next year. It offers high quality graphics and a straightforward and intuitive interface. Choosing an all in one account that links your bank, Demat, and trading accounts is a convenient and time saving option. “Options are one way to generate income when the markets aren’t going up. TD Ameritrade’s thinkorswim is a top stock trading app for active traders. Your losses are much more magnified and exponential on the short side. Those passionate about finance, numbers, and the economy should have no problems learning how to trade. Create profiles for personalised advertising. Registered Office: Kasumigaseki Building 25F, 2 5 Kasumigaseki 3 chome, Chiyoda ku, Tokyo, 100 6025 Japan. Schwab’s chat support with a human operator answered almost immediately, a rare luxury. Market Wizards: Interviews with Top Traders by Jack D Schwager. Users should also be sure to use a secure internet connection and consider setting up two factor authentication for added security. The app and website are free to use, but you pay for it by needing to click to close advertisements pretty frequently. Below are some essential bilateral trading patterns. A profit is made on the difference between the prices the contract was bought and sold at. This may not be a good strategy. The cost of trading forex depends on which currency pairs you choose to buy or sell.

Tp Play Game Register and Download Get 600rs Bonus

On 3 Jan 2023, the Portuguese Securities Market Commission CMVM issued a warning that Quotex was not authorised to carry out any type of financial intermediation activity in Portugal. Trading for beginners can be exciting – and overwhelming. Our receipt of such compensation shall not be construed as an endorsement or recommendation by StockBrokers. Fundamental analysis will measure a company’s intrinsic or actual monetary value by taking into consideration certain economic and financial factors, like its balance sheet, management forecast and macroeconomic markers. For the brokers that filled out these profiles, we audited the information for any discrepancies between our data and the broker’s data to ensure accuracy. Engaging in pump and dump schemes will result in consequences. Funding options for stock trading apps commonly include bank transfers, debit card deposits, and sometimes credit card or e wallet transfers. You may visit: DI/FinancialIntermediaries/Pages/20230103d. Binary options are priced between $0 and $100, so you can decide how much capital you can risk. Volatile stocks are targeted in such cases, and procured shares are sold off as soon as a massive movement in prices is witnessed. However, at some point, you’ve got to generate your own ideas, trust your own instincts, and believe in yourself. However, many experienced traders usually choose between first 30 minutes of the market hours, or those looking at higher price movements go for the last 45 minutes and the rest do it in the remaining hours from 10 AM to 2:45 PM. Energy and grains to shine as metals pause. This account is used to determine the gross profit or gross loss of a business entity by comparing the revenue from sales with the cost of goods sold. The biggest geographic trading center is the United Kingdom, primarily London. Securities and Exchange Commission. Tick charts provide an effective tool for day traders by capturing swift market changes in real time. The initial bearish candle represents a period of selling pressure, but the subsequent bullish candle that opens below the previous candle’s low and closes above its midpoint indicates a strong resurgence of buying interest. Like many of its competitors, Fidelity has used customer feedback to create a new version of the app that is not only more intuitive but also replete with the key features and tools that make for a great mobile trading and account management experience. Why was I able to manage my risk properly while playing poker and not while trading. Paper trading can help you learn about the market, improve your decision making, and avoid costly mistakes. A hammer candlestick pattern is a single candlestick pattern that suggests a potential reversal of the overall bullish trend. Profit and Loss Account for Mr. In other words, bulls saved the stock and trapped the bears. Based brokerage firms are safe against theft and broker insolvency. Founded in 2005, MultiBank has a long track record as a CFD broker and has grown to have a major global presence. I know people who have won free crypto.

CTrader

At this point, you might be noticing other patterns and asking. The holidays falling on Saturday / Sunday are as follows. You are advised not to trade on the basis of SMS tips and to take an informed investment decision based on authentic sources. Shares of ImClone took a sharp dive when it was found out that the FDA rejected its new cancer drug. Investments in the securities market are subject to market risk, read all related documents carefully before investing. We adhere to strict guidelines for editorial integrity. Therefore, his overall profit from the transactions is –. The app is distinguished by its swift order execution and real time stock updates, enhancing the trading experience for its users. Use automated tools to invest regularly. Suppose a trader wants to invest $5,000 in Apple AAPL, trading at around $165 per share. In an option contract this risk is that the seller will not sell or buy the underlying asset as agreed. As a prop trader, you take home 90% of your profits for most assets and don’t shoulder any losses. Discover risk free trading with Neostox’s virtual trading platform. Evaluate Your Performance: Intraday trading is dynamic. Coinbase’s more than 200 tradable coins should satisfy most looking to break into the crypto space. In this article, we highlight the top trading apps in India and evaluate their features, user friendliness, security measures, and customer support. Now, no matter what kind of strategy you use for intraday trading, it is always advisable to have a proper risk management plan. Traders can use CFDs to speculate on options prices – instead of trading them directly. In conclusion, while trading may sound like a foreign concept to new potential traders, it is important to keep in mind that no one was born knowing how to trade. Therefore, understanding and analyzing volume can provide valuable insights into market trends and potential trading opportunities. It’s a scene straight out of “Boiler Room. Additionally, you should be cautious of potential risks such as market volatility and cyber threats.

OPEN FREE DEMAT AND TRADING ACCOUNT IN 15 MIN

Earnings per equity share for continuing operation. What to look out for: One thing to keep in mind is that if you’re an automated investor, Fidelity Go charges more https://pocketoptionono.online/ for higher account balances. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The reason for this is curve fitting, which will cover in just a moment. With many exchanges operating in various time zones, it is important to be aware of each market’s calendar and trading hours. Stay updated with the weekly analysis written by our experts, covering macroeconomic events and their impact on financial markets. Refer to these for more detailed information about how a specific calculator works. “Each candlestick is a simple, yet powerful tool to understand what’s happening in the market”. But it has two failings.

NSE NMFII

We shall Call/SMS you for a period of 12 months. It consists of two distinct lows that are roughly equal and separated by a peak in between. Com App in certain jurisdictions due to potential or actual regulatory restrictions. Leading exchanges like Binance and KuCoin have been hacked, resulting in tens of millions of dollars in losses. The book delves into the behaviour of a group of short sellers and explains why they choose to pursue their strategy. A stock’s correlation is determined by the following: correlation coefficient, scatter plot, rolling correlation, and regression analysis. Iv Intangible assets under development. Take a moment to let this quote soak in because it does take a few reads to comprehend fully. Each options contract will have a specific expiration date by which the holder must exercise their option. Three types of charts are used in forex trading.

DOWNLOAD THE APP

What if ISI had bucked the trend and lost 0. Looking to open a new account. He holds the Chartered Financial Analyst CFA and the Chartered Market Technician CMT designations and served on the board of directors of the CMT Association. If you want more data points, you can use my broker comparator. The currencies you want to trade and swap are called a currency pair. You’ll also have access to the more advanced StreetSmart Mobile. Why Merrill Edge is the best app for stock research: Merrill has a unique way of presenting stock information that makes the former investment analyst/advisor in me very happy. On Mirae Asset’s secure website. That’s why we created IG Academy, a self learning hub on our platform, full of interactive online courses, webinars, and live sessions with our resident experts. Leverage is the use of a smaller amount of capital to gain exposure to larger trading positions, also known as margin trading. Learn more about scalping. FINRA defines a “pattern day trader” as any investor who executes four or more day trades within five business days once the number of day trades is more than 6% of the trades in the margin account for that period. Margin trading involves interest charges and heightened risks, including the potential to lose more than invested funds or the need to deposit additional collateral. List of Partners vendors. By purchasing a call option, the trader gains the right to buy the asset at a lower, predetermined price, potentially profiting from the price increase. Gaps are points in a market when there is a sharp movement up or down with little or no trading in between, resulting in a ‘gap’ in the normal price pattern. Written by Michael Lewis, the narrative revolves around a few main players who bet against the subprime mortgage market and ended up profiting from the financial crisis of 2007 to 2008. Please note that FTMO does not guarantee the accuracy, completeness or timeliness of the content provided by this website. The new data feed appears to revert back to the pre October 2009 situation or close to it, with trades “bundled” and allocated to the “aggressor”. Research and Analysis. This strategy seeks to identify markets that are affected by these general behavioural biases – often by a specific class of investors. Blain’s insights have been featured in the New York Times, Wall Street Journal, Forbes, and the Chicago Tribune, among other media outlets. Take self paced courses to master the fundamentals of finance and connect with like minded individuals. While day ahead trades are related to market clearing price principles, where the last accepted bid sets the price for all transactions, the prices in intraday trading are set in a “pay as bid” process. Hey, I’m Pedro and I’m determined to make someone a successful trader. As these expert quotes convey, it is not enough to have a mastery over technical analysis or to understand the economic indicators; traders must also possess an innate ability to evolve with the market’s rhythm, applying discipline in their trading habits through protective measures and adaptive strategies. What Is Swing Trading. Let’s see together some of the most popular strategies to use.